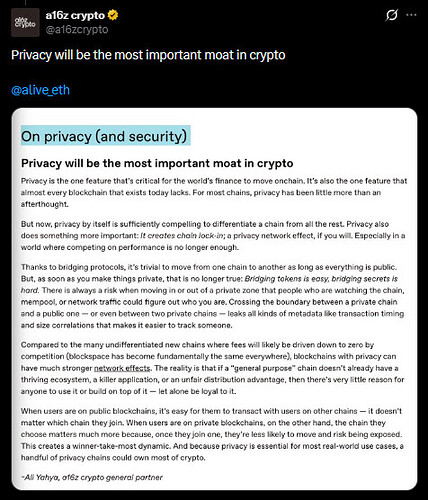

Privacy is no longer a nice-to-have feature in crypto. It is becoming the moat.

By 2026, blockchains without native privacy will struggle to onboard real usage across finance, enterprises, and retail users. This is why Andreessen Horowitz has argued that privacy will be the most important competitive advantage in the next phase of crypto adoption.

The logic is straightforward. Almost every major chain today is transparent by default. That works for experimentation, but it breaks down fast when sensitive activity enters the picture.

Salaries, business transactions, trade flows, identity credentials, and compliance data cannot live fully on public ledgers.

A network that can protect sensitive information creates a powerful lock-in effect.

Bridging tokens is easy. Bridging secrets is hard.

Once users or organizations entrust a chain with private activity, leaving that ecosystem becomes risky. Moving to a public chain can expose identities, counterparties, or transaction history. That friction creates a winner-take-most dynamic, where a small number of privacy-first platforms can capture disproportionate usage and liquidity.

Signals are already visible

In the past year, adoption signals around privacy have clearly strengthened. On Zcash, roughly 30 percent of the circulating supply now sits in shielded addresses, up from around 10 percent the year before. That shift shows users actively choosing confidentiality when the option is available.

Market behavior reinforced the privacy signal in 2025. Zcash surprised many observers with a sharp rally, rising roughly 248% in October 2025 and briefly reaching a market capitalization of around $6.5 billion. While price alone is never the thesis, the timing is notable. The move coincided with renewed attention on privacy as a structural requirement, not a niche feature.

Other privacy-oriented networks such as Monero and Dash also saw increased usage and development activity. Even traditionally transparent chains are adapting. Litecoin integrated MimbleWimble extensions, acknowledging that optional confidentiality is becoming table stakes for digital money.

Institutional interest is following the same trajectory. Grayscale launched a Zcash Trust, and funds increasingly treat privacy assets as strategic exposure rather than fringe bets.

As Bitget CEO Gracy Chen observed, this is no longer about hiding illicit activity. It is about protecting sensitive business data in a way that remains auditable and regulatorily sound.

Privacy is not anonymity

This distinction matters.

Regulators have shown clear hostility toward systems that enable total anonymity with no accountability, as seen in actions against mixers like Tornado Cash. At the same time, they appear far more open to privacy-with-compliance models.

Real-world systems already operate this way. Your salary is private to coworkers, visible to your bank, and reportable to tax authorities. Blockchain infrastructure needs to replicate that nuance if it wants enterprise and public-sector adoption.

At the Midnight Summit, this idea came through clearly: privacy is about controlling what you reveal, when, and to whom, not about disappearing from oversight entirely.

Why this converges in 2026

Multiple forces are aligning:

-

Growing user demand for confidentiality

-

Institutional capital rotating into privacy infrastructure

-

Rapid advances in zero-knowledge proofs

-

A regulatory shift toward selective disclosure rather than blanket transparency

This is why venture analysts increasingly describe privacy as crypto’s strongest moat. Chains that remain fully public will struggle to support complex financial and institutional use cases. Chains that are private by default, provable when needed gain a structural advantage.

If that balance is achieved at scale, privacy-preserving platforms will not just compete in the next cycle. They will define it.

Why Midnight is positioned differently

This is where Midnight enters the picture.

Most privacy-first networks solved one part of the problem: hiding transactions. That mattered early, but it is not enough for the next phase of adoption. Enterprises, institutions, and governments do not need invisibility. They need control.

Midnight is designed around that distinction. Its core premise is not anonymity, but rational privacy: private by default, selectively disclosable when required. Data can remain confidential while still being provable to auditors, regulators, or counterparties through zero-knowledge proofs.

That design choice is not cosmetic. It directly addresses the main blockers that have kept real-world finance and identity systems off-chain.

This is also why Midnight has attracted disproportionate interest so early, reaching a $1B valuation in a short time frame, alongside strong volume and ecosystem attention. This reflects a market recognizing that privacy-with-compliance is underbuilt and increasingly non-negotiable.

Midnight also benefits from its hybrid architecture. Sensitive logic and data live in a private execution environment, while settlement, governance, or liquidity can still interface with public chains. That means developers do not have to choose between privacy and composability. They can have both.

In other words, Midnight is not competing to be the most opaque chain. It is positioning itself to be the most usable private infrastructure layer.

If privacy is the moat in crypto’s next cycle, then the winners will not be the projects that hide the most, but the ones that let users reveal exactly what is needed, and nothing more. Midnight is built for that reality.

If this model proves itself at scale, Midnight will not just benefit from the shift toward privacy. It will define what privacy in Web3 actually means.